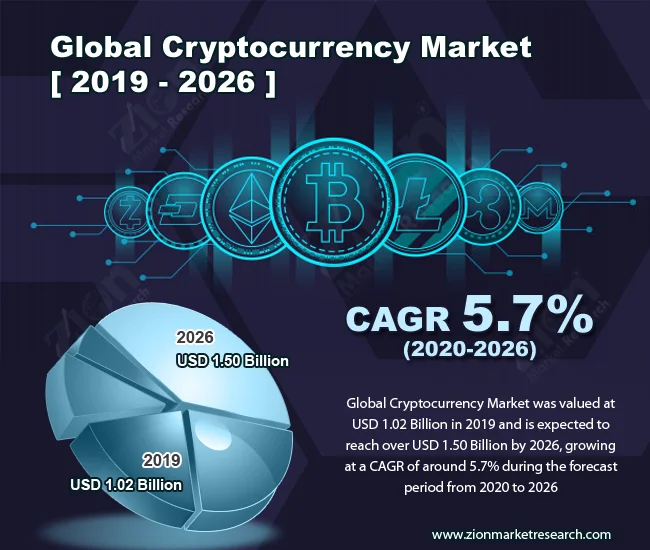

Alright, let's get one thing straight: anyone who claims to know what's gonna happen in crypto in 2026 is either delusional or selling you something. Probably both. But hey, that won't stop me from ranting.

Regulatory Reality Check: The Adults Are (Finally) in the Room

So, 2025 was the year regulators finally started to figure out that crypto wasn't just a fad for basement-dwelling libertarians. We're talking about the GENIUS Act in the US, MiCA in Europe... suddenly, "compliance" isn't a dirty word anymore.

TRM Labs says regulatory clarity fueled institutional adoption – about 80% of jurisdictions saw financial institutions announcing digital asset initiatives. Color me skeptical. "Regulatory clarity"? More like "regulatory threat." These suits aren't suddenly embracing decentralization; they're circling like vultures, waiting to pick apart the carcass of unregulated finance.

And speaking of vultures, what's with the Basel Committee? They're "reassessing" their proposed rules that would've basically nuked banks' crypto exposure? Give me a break. It ain't about being "fair"; it's about not getting left behind while the rest of the world figures out how to make money off this crap.

But is all this regulation actually working? TRM analysis claims VASPs (the regulated ones) have "significantly lower rates of illicit activity." Okay, but what about the unregulated ones? The DeFi platforms? The North Korean hackers making off with $1.5 billion in Ethereum? That's the real story, ain't it? You can read more about the regulatory outlook in the Global Crypto Policy Review Outlook 2025/26 Report.

Here's a question nobody seems to be asking: if regulation is so great at stopping bad guys, why do we still have money laundering in traditional finance? Are we really supposed to believe some new set of rules is going to magically solve everything in crypto? I'm not holding my breath.

Bitcoin's Midlife Crisis: From Savior to... What Exactly?

Bitcoin at $85,000? What happened to the "digital gold" narrative? Last time I checked, gold doesn't tank 6% in a day because the Bank of Japan sneezed.

XS.com says Bitcoin is in a "strong correction and restructuring phase." Translation: it's crashing, but don't panic, HODLers! It's just a "restructuring phase!" Yeah, that's what they all say right before the whole thing implodes.

And then there's Strategy, the company that owns more Bitcoin than some small countries. Their CEO, Phong Le, casually mentions they might sell some of their hoard? That's like the captain of the Titanic saying, "Yeah, we might need to use the lifeboats at some point."

VALR's CEO, Farzam Ehsani, says MSCI might exclude crypto-holding companies, leading to "forced sell-offs." Forced sell-offs? Is that like when your landlord "forces" you to move out because you haven't paid rent in six months? Crypto Market Update: Strategy Faces MSCI Index Removal, SEC Freezes Ultra-Leveraged ETF Approvals discusses the potential impact of MSCI's decision.

Offcourse, the Bitcoin maximalists are probably screaming about "FUD" right now. Fine, maybe it'll bounce back to $100,000 in December. Maybe pigs will fly. Maybe I'll win the lottery and move to Tahiti. But let's be real: Bitcoin's looking shaky, and all the "HODL" memes in the world aren't gonna change that.

The Real Question: Is Crypto Even Necessary Anymore?

Look, I get it. The promise of crypto was always about freedom, decentralization, sticking it to the man. But what have we actually gotten? Scams, hacks, environmental damage, and a bunch of rich dudes getting even richer.

Franklin Templeton launching a Solana ETF? Goldman Sachs buying Innovator Capital Management? These aren't signs of a revolutionary technology; they're signs of Wall Street colonizing yet another corner of our lives.

And Tether? Don't even get me started. S&P downgrades their peg stability, and Tether's CEO cries "propaganda"? Give me a break. If your stablecoin needs constant defending, maybe it ain't so stable after all.

I'm not saying crypto is dead. It's just... lost its way. Somewhere between the whitepaper and the Lambo, it forgot what it was supposed to be about.

A Slow, Painful Death by Regulation?

So, What's the Real Story?

Honestly, I'm starting to think the best-case scenario for crypto in 2026 is a slow, grinding decline into irrelevance. Regulation will choke the innovation, Wall Street will suck out the profits, and the original vision will be buried under a mountain of compliance paperwork.

Maybe I'm wrong. Maybe some new technology will come along and save the day. Maybe Bitcoin will moon to a million dollars and we'll all be sipping Mai Tais on our private yachts. But let's be real – ain't none of that gonna happen. The future of crypto looks less like a revolution and more like a really complicated spreadsheet.